Any articles, templates, or information provided by Smartsheet on the website are for reference only. Any reliance you place on such information is therefore strictly at your own risk. The Smartsheet platform makes it easy to plan, capture, manage, and report on work from anywhere, helping your team be more effective and get more done. Report on key metrics and get real-time visibility into work as it happens with roll-up reports, dashboards, and automated workflows built to keep your team connected and informed. When inserting rows, make sure to copy the formulas in the Total and Average columns. Keep in mind that spreadsheets allow you to make more mistakes than software like Quicken, because spreadsheets use formulas and calculations that you may mess up by accident.

Cash flow statement template

For more information on how Sage uses and looks after your personal data and the data protection rights you have, please read our Privacy Policy. This guide covers basic manufacturing accounting terms you should know and what to look for when choosing an accounting software. The buying and selling of investments such as IP rights or contracts and the collection and issuance of loans from the business to subsidiaries of the company. Operating activities refer to the company’s primary revenue-producing activities.

Direct vs. Indirect Cash Flow Methods

- Subtract any cash disbursed from purchasing marketable securities, or other investments such as contracts or IP rights.

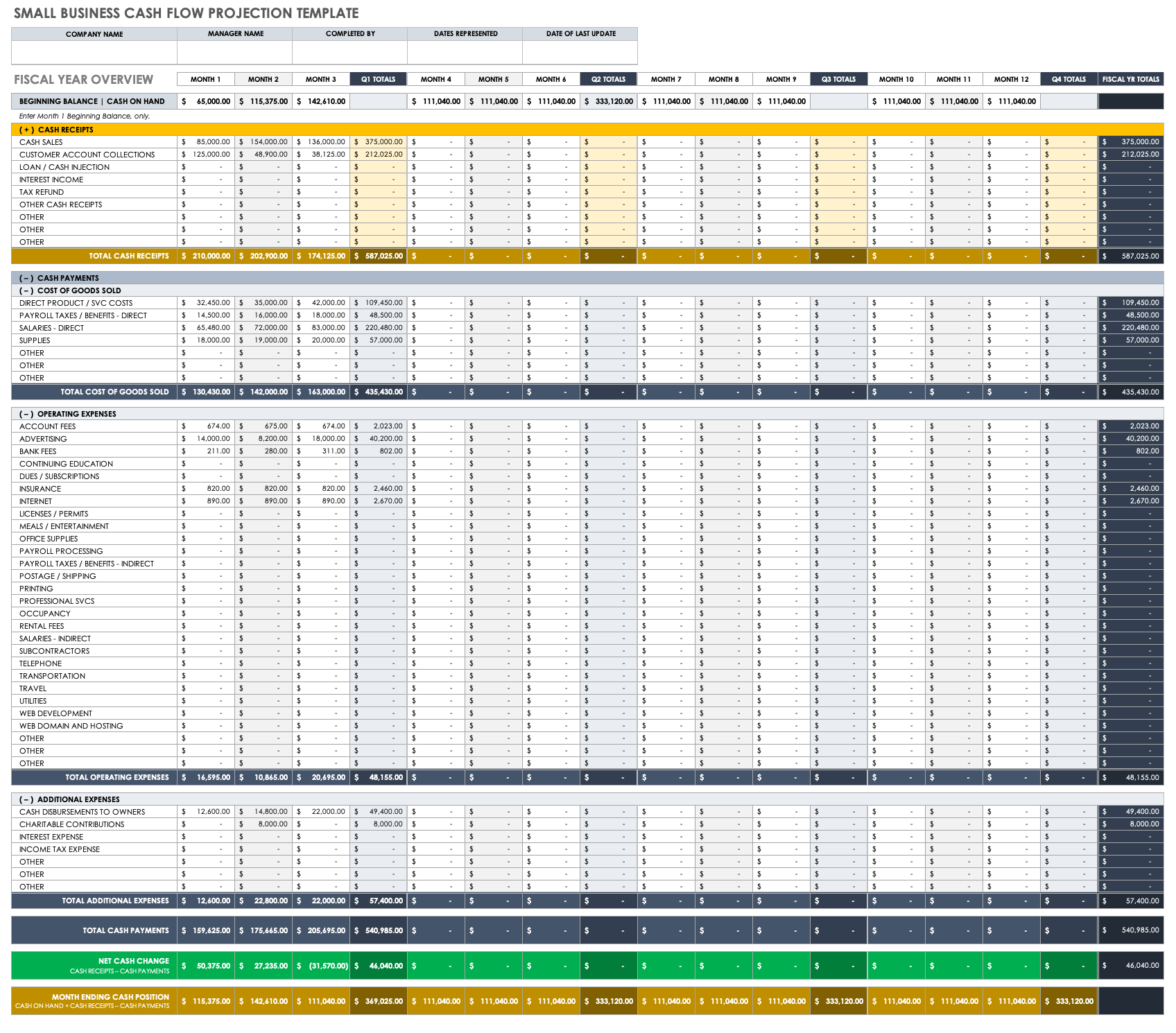

- The template provides a way to examine day-by-day, month-by-month, quarter-by-quarter, or year-over-year projected cash receipts and cash payments as compared to your operating expenses and other outflows.

- The Discounted Cash Flow Template from Smartsheet is an all-in-one solution for detailed financial analysis and business valuation.

- Use a cash flow statement as well as cash flow projections to clarify your company’s position on cash.

- Depending on your business needs, you can extend these forecasts weekly, monthly, or yearly.

For example, if a long-term liability line changes to a short-term accrued liabilities line, it’s easy to double-count the items and artificially skew your cash flow. Likewise, remember to account for capital lease additions—non-cash additions of the right-of-use asset and liability—by removing their impact from the cash flow worksheet. The indirect method begins with net income, so it only stands to reason that inaccurate or incomplete data threatens the reliability of the entire worksheet. That leads to inaccuracies in your statement of cash flows which, as the kids say, is no bueno. Start your cash flows early, plug in your big transactions—both anticipated and completed—then wait on the items that are just indirect changes, linking data as you go to save time and frustration down the road.

Printable Monthly Cash Flow Worksheet

But many may not realize the value of seeing those financial results in graphical form. Company Cash Flow Planner spreadsheet is a spreadsheet to plan more detail about your company cash flow. It fits small business companies who manage their tight cash flow where their expenses rely upon… It’s important to always keep your objective in mind when choosing the right tools for your business.

Discounted Cash Flow Template

Make sure to include line items for cash paid to employees, suppliers, and on interest. On the other hand, having too much cash or cash equivalents on hand can be a sign you’re not taking full advantage of your liquid assets. To save money in the long run, you may want to use cash to pay down high-interest debts, for example. They include cash along with liquid investments you can quickly convert into cash.

Subtract any cash disbursed from purchasing marketable securities, or other investments such as contracts or IP rights. Subtract payment of monies in the form of loans made to others, typically subsidiary companies. Such as license income, the share of profits from joint ventures or grant monies received. The starting balance can be placed at the top or the bottom of the statement. With one account for multiple currencies, it’s easier than ever to connect with customers and suppliers overseas. Pay and get paid with fast international transfers all over the world, while cutting your bank costs and boosting your profits.

This template is a basic starting point, so it’s not appropriate for larger businesses who require something more detailed and long-lasting. Income statements also called profit and loss (P&L) statements confirm how profitable a company is. Cash equivalents are investments designed to meet short-term cash commitments. The value of any foreign currency should reflect the exchange rate on the date the company received the cash.

Because we are treating transfers to these types of savings as Outflows from cash accounts. If you included your Retirement Fund in the cash balance, then it wouldn’t make sense to include “Retirement Fund” as an Outflow. Note again that this is meant to show how much cushion your spending account has. If you want a more comprehensive workflow for your finance team, or you need help using the Google Sheets or Excel cash flow template, talk to our automation experts. This comprehensive overview makes it easy to spot trends, manage spending, and ensure the health of your finances. Whether you’re running a small business, freelancing, or managing your personal finances, this template is a must-have tool.

This simple cash flow forecast template provides a scannable view of your company’s projected cash flow. Sections include beginning and ending cash balances, cash sources, cash uses, and cash changes during the month. These details provide an accurate picture of your company’s projected month-by-month financial liquidity. Ultimately, this template will help you identify potential issues that you must address in order for your business to remain on sound fiscal footing.

The template provides a way to examine day-by-day, month-by-month, quarter-by-quarter, or year-over-year projected cash receipts and cash payments as compared to your operating expenses and other outflows. In order to set yourself up for success, it’s imperative to be realistic when forecasting cash accounts receivable and accounts payable flows. The Budget Cash Flow Template is a comprehensive tool designed to help businesses manage and predict their cash flow throughout the year. This Google Sheets template provides you with clear insight into the financial health of your business by tracking both cash inflows and outflows.

Float provides a 12 month overview that provides a simple cash-in, cash-out format that needs to be manually updated. The Tiller Money Feeds add-on allows you to automatically connect your transactions to your financing templates, including data from banks, credit cards, brokerages and mortgages. It will also help you see trends and make informed decisions for the future of your organization. Our cash management software also automates tasks and provides real-time, reliable cash flow visibility.