This way an accountant or bookkeeper can analyze the amount of cash collected and recorded during a period separate from all other journal entries in the general journal. Again, the three column cash ledger diagram below shows only one side of the cashbook, in this case the left hand receipts side (debit). The two column cash ledger book is sometimes referred to as the double column cash book or the 2 column cash book. Again, for simplicity, the two column cashbook ledger diagram below shows only one side of the cashbook, in this case the left hand receipts side (debit). Again, for simplicity, the two column cashbook ledger diagram below shows only one side of the cashbook, in this case the left hand receipts side (debit) .

Stay up to date on the latest accounting tips and training

- The column simply lists the discounts as with any other book of prime entry.

- A general journal is used to record unique journal entries that cannot be processed in a more efficient manner.

- 11 Financial’s website is limited to the dissemination of general information pertaining to its advisory services, together with access to additional investment-related information, publications, and links.

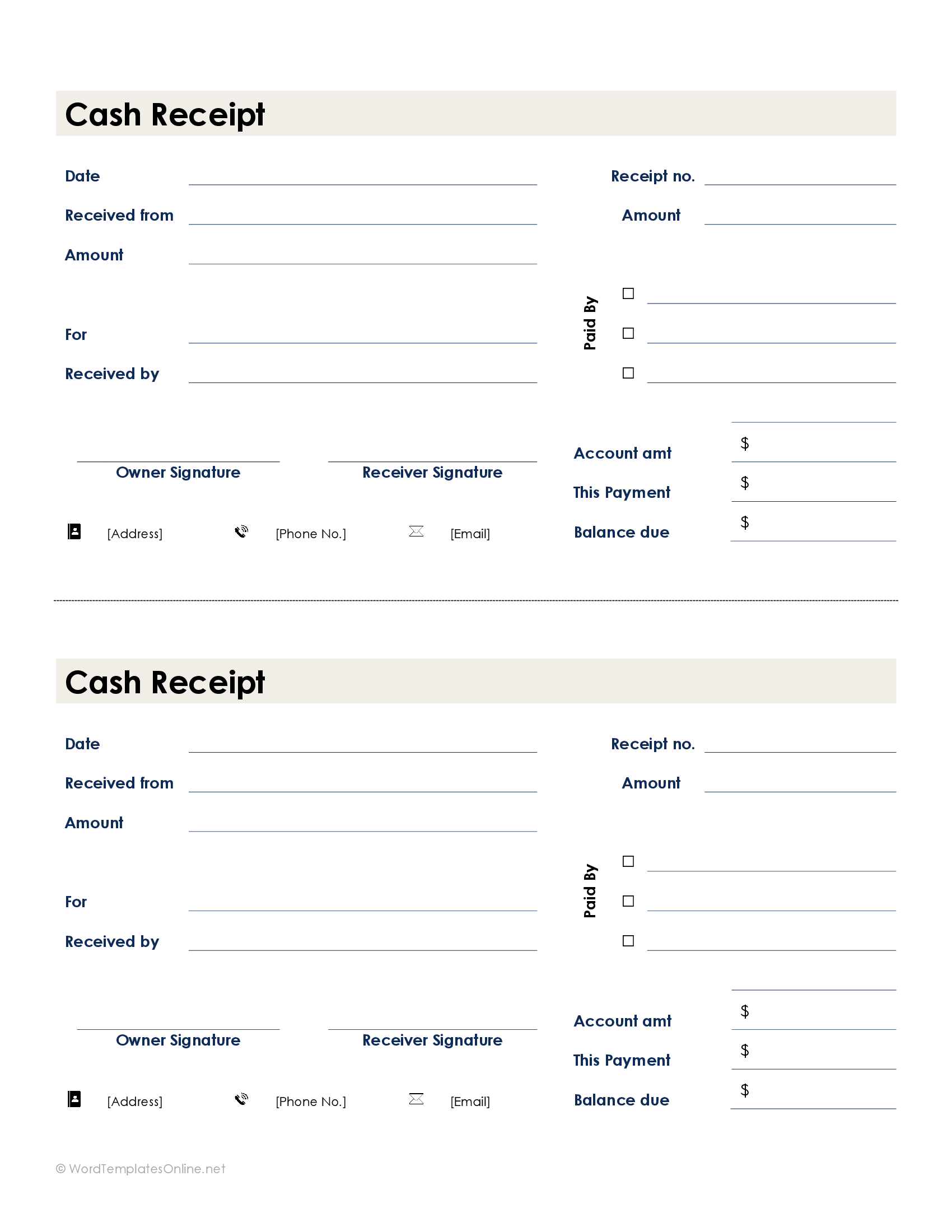

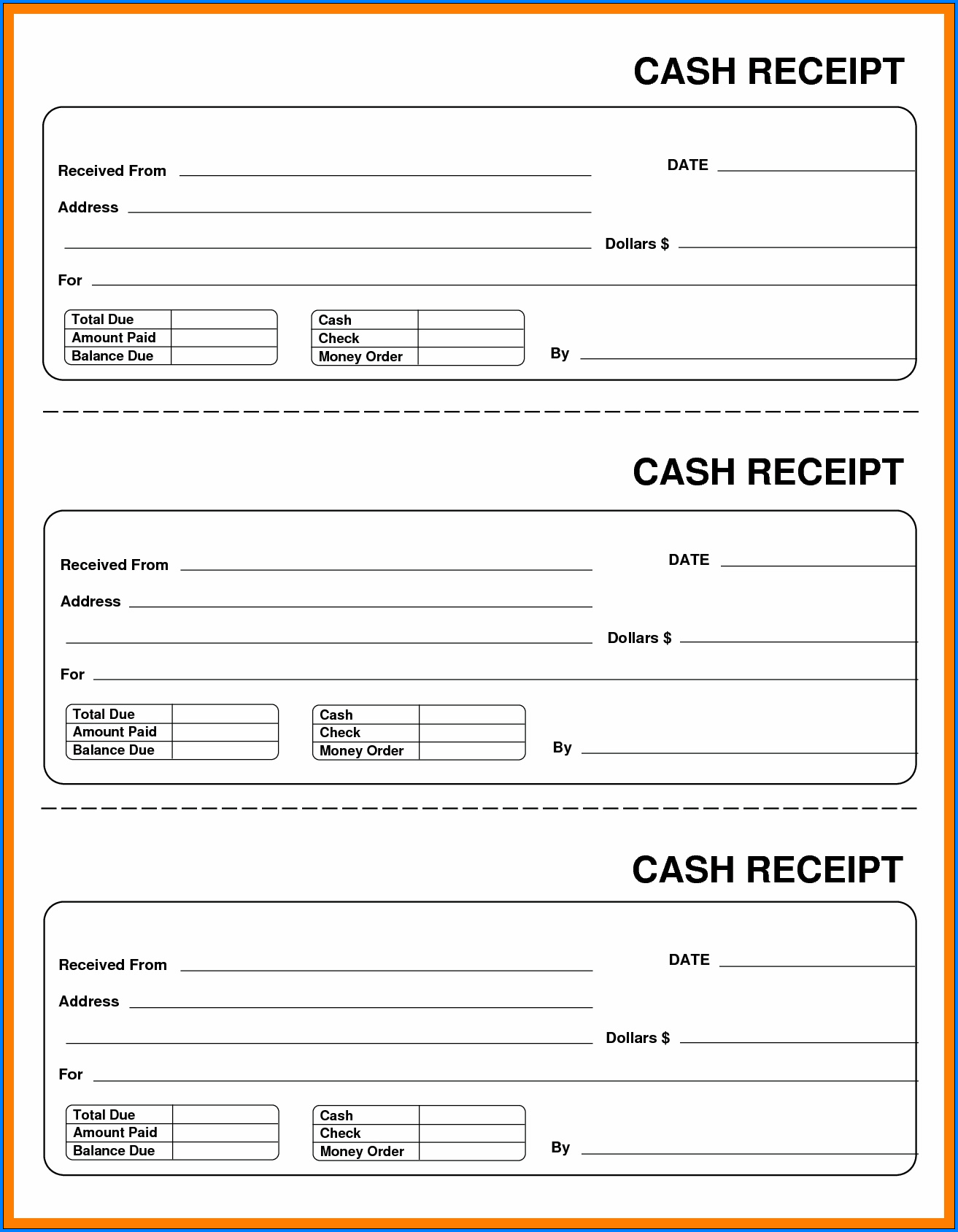

- If you accept checks, be sure to also include the check number with the sales receipt.

- You must also track how these payments impact customer invoices and store credit.

11 Financial’s website is limited to the dissemination of general information pertaining to its advisory services, together with access to additional investment-related information, publications, and links. For the past 52 years, Harold Averkamp (CPA, MBA) hasworked as an accounting supervisor, manager, consultant, university instructor, and innovator in teaching accounting online. For the past 52 years, Harold Averkamp (CPA, MBA) has worked as an accounting supervisor, manager, consultant, university instructor, and innovator in teaching accounting online. Ask a question about your financial situation providing as much detail as possible.

Cash receipts accounting steps

Cost of goods sold is debited for the price the company paid for the inventory and the inventory account is credited for the same price. It differs from the cash receipts journal in that the latter will serve to book sales when cash is received.The sales journal is used to record all of the company sales on credit. A cash receipts journal is a record of financial transactions that includes bank deposits and withdrawals as well as all cash payments and receipts. The general ledger account is then updated with the cash receipts journal entries.

Sales journal with a “sales tax payable” column

One of the journals is a cash receipts journal, a record of all of the cash that a business takes in. You may sell items or provide services that people pay for with cash, which may range from food or books to massages or even a ride in a taxicab. SequentiallyAccount-wiseDebit and CreditColumnsSidesNarrationMustNot necessary.BalancingNeed not to be balanced.Must be balanced.

Why You Can Trust Finance Strategists

There may be a large number of entries into this journal, depending on the frequency of cash receipts from customers. Read on as we take a closer look at what a cash receipts journal is, the different types, and the pros and cons. You must be able to substantiate certain elements of expenses to deduct them on your tax return. Cash Basis Accounting is a type of accounting whereby all of the company’s revenues are recognised upon actual cash receipt and all of the expenses are recognised upon payment. It also ensures that the business can keep track of all the account receivables and aged receivables.

When a company receives a loan from a bank, a transaction is performed in the cash sales collections journal to record the loan. The main objective of a cash receipts journal is to properly manage cash by making it simple to ascertain cash balances at any given time, enabling managers and corporate accountants to budget their cash. Regularly, an overall sum of the journal balance is calculated and sent to the general ledger. When looking into a specific cash receipt, a person would start with the general ledger before descending to the cash receipts log, where they might find a reference to the particular receipt. Depending on the nature of the business involved the two columns can be used for different purposes.

The cash receipts journal is used to track transactions where a shop or wholesaler sells products to a customer and receives payment in cash. Whenever a company receives cash for any reason, the journal entry is recorded in the cash receipts journal. Other sources of cash often include banks, interest received from investments, and sales of non-inventory assets. When a business gets a loan from a bank, the transaction to record the loan is made in the cash collections journal. Credit sales and sales made on account are not usually recorded in this journal because there isn’t any cash collected in these transactions.

A cash receipts journal is a special journal within the general journal that is used specifically to record all the cash receipts. It has a total record of all the cash collections during an accounting period. When a retailer sells merchandise to a customer and it collects cash, this transaction is recorded in the cash receipts journal.

Shaun Conrad is a Certified Public Accountant and CPA exam expert with a passion for teaching. After almost a decade of experience in public accounting, he created MyAccountingCourse.com to help people learn accounting & finance, pass the CPA exam, and start their career. Take self-paced courses to master the fundamentals of finance and connect with like-minded individuals. A financial professional will offer guidance based on the information provided and offer a no-obligation call to better understand your situation.

In addition, the post reference “cr” is recorded to indicate that these entries came from the the super bowl. Again, in the general ledger accounts, the post reference “CR-8” is recorded to indicate that these entries came from page 8 of the cash receipts journal. At the end of the month, the different columns in the cash receipts journal are totaled. The totals from all the amount columns (other than the other account column) are posted to the appropriate general ledger accounts.